Holiday Party Deductible 2025. These dates may be modified as official changes are announced, so please check back. Writing off meals and entertainment for your small business can be pretty confusing.

These dates may be modified as official changes are announced, so please check back. In general, holiday parties are fully deductible (and excludible from recipients’ income).

But, it is always recommended to consult with a qualified tax professional or accountant to determine the tax deductibility.

The short answer is yes, holiday parties can be tax deductible, but there are some important caveats to keep in mind.

Benefits for Employees Through Holiday Parties Are Holiday Party, To qualify for the 100 percent. You generally can deduct no more than $25 of the cost of business gifts you give directly or indirectly to each person during your tax year.

21 Ideas for Workplace Holiday Party Ideas Home, Family, Style and, If customers and others attend, holiday parties may only be partially deductible. 100% of the costs associated with throwing a party for employees and their spouses or significant others is tax.

The Employer's Guide to Deducting Company Holiday Party Expenses, If customers and others also. Here are some common examples of 100% deductible entertainment and meal expenses:

Is My Holiday Party Deductible?, Here are some of the most common exceptions that may still be tax deductible in 2025 or 2025—expenses for events like the company holiday party,. If you invite a blend of clients and employees to the same.

Christmas Questions! Staff Parties & Gifts! What Is Deductible? TSP, Holiday parties are fully deductible (and excludible from recipients’ income) so long as they’re primarily for the benefit of employees who aren’t highly compensated. If you invite a blend of clients and employees to the same.

Some Holiday Parties and Gifts are Tax Deductible Landmark, This article is tax professional approved. Here are some of the most common exceptions that may still be tax deductible in 2025 or 2025—expenses for events like the company holiday party,.

When holiday gifts and parties are deductible or taxable Kehlenbrink, If customers and others also. Holiday parties are fully deductible (and excludible from recipients’ income) so long as they’re primarily for the benefit of employees who aren’t highly compensated.

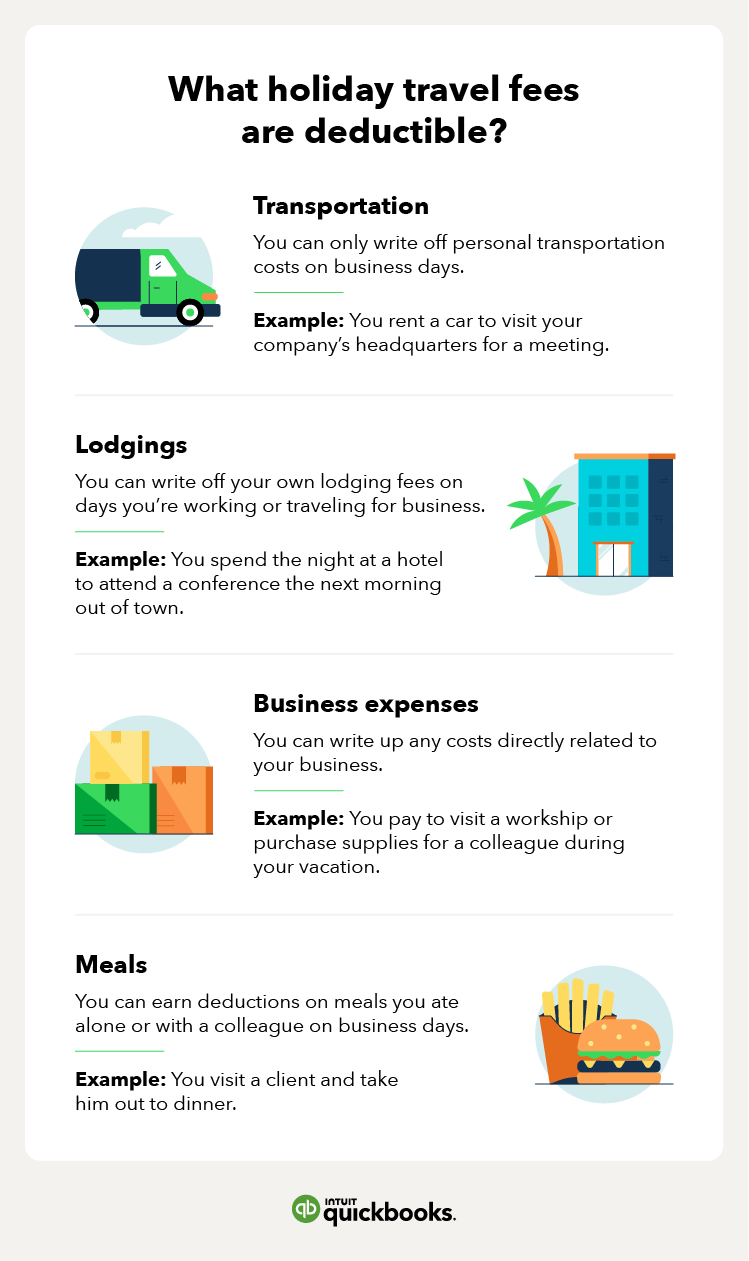

Travel expense tax deduction guide How to maximize writeoffs QuickBooks, If you invite a blend of clients and employees to the same. With the new year just around the corner, the central government has released the list of gazetted and restricted holidays for 2025.

Holiday Office Party Deductions 4 Rules LawInc, To qualify for the 100 percent. With the new year just around the corner, the central government has released the list of gazetted and restricted holidays for 2025.

Is Your Company Holiday Party Tax Deductible?, These dates may be modified as official changes are announced, so please check back. Holiday parties are fully deductible (and excludible from recipients’ income) so long as they’re primarily for the benefit of employees who aren’t highly compensated.

With the new year just around the corner, the central government has released the list of gazetted and restricted holidays for 2025.